In the frosty embrace of Norway’s rugged terrain, a revolution quietly brews. The landscape, often associated with dramatic fjords and towering glaciers, has emerged as a beacon for cryptocurrency enthusiasts, especially Bitcoin miners. The synergy between this northern haven’s natural resources and technological advancements has made it an attractive hub for retail miners looking to turn their passion into profit.

With electricity prices among the lowest in Europe, powered by abundant renewable energy, Norway is a strategic choice for those investing in mining machines. By harnessing the efficient and sustainable energy sources, miners are able to keep operational costs to a minimum while maximizing their returns. This unique environment cultivates a flourishing ecosystem for retail miners eager to stake their claim in this volatile marketplace.

The word “miner” may evoke images of dark caverns and heavy machinery, yet in the realm of cryptocurrencies, it refers to the individuals and entities engaged in blockchain validation. By deploying mining rigs, these operators solve complex mathematical problems, confirming transactions on the network, and, in return, are rewarded with Bitcoin. The process not only fortifies the integrity of the currency but also creates a lucrative opportunity in today’s digital economy.

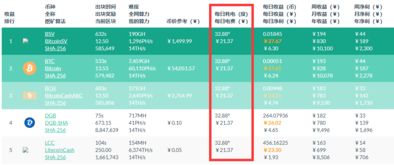

Retail miners, typically small-scale operators, wrestle for a piece of this pie. They invest in mining machines, each piece of hardware representing a significant capital outlay. The choice of equipment impacts profitability, with various models offering differing hashing power and energy consumption rates. With the market flooded with options ranging from ASICs to GPUs, making the right decision becomes crucial for maximizing ROI. The stakes are high; selecting an efficient miner can spell the difference between profit and loss.

Moreover, the hosting of mining machines has become increasingly popular. Retail miners can often find shared facilities operated by experienced firms, allowing them to delegate the cumbersome task of maintenance and management. This model offers an efficient alternative, as hosting services often provide favorable electricity rates, advanced cooling systems, and networking infrastructure tailored for optimal performance.

As Bitcoin’s dominance continues, eyes are also turning to alternative cryptocurrencies such as Ethereum (ETH) and Dogecoin (DOG). Each currency has its mining protocols and requirements, leading to distinct mining experiences and profitability metrics. Mining ETH, for example, involves different equipment and energy considerations compared to Bitcoin mining. Consequently, savvy miners diversify their operations by engaging with multiple cryptocurrencies, spreading their risk and potentially increasing their returns.

In addition to hardware and hosting services, exchanges play a pivotal role in the strategy of retail miners. The volatile nature of cryptocurrency prices demands that miners be astute in their trading practices. Constant market analysis, paired with timely transactions, can mean the difference between holding onto coins through price dips or capitalizing on spikes in value. Thus, knowledge about exchanges is as essential as knowledge about mining technology.

The operational landscape for retail miners in Norway is not without challenges. Market fluctuations, regulatory changes, and technological advancements can all impact profitability. Miners must stay vigilant and adaptable, ready to pivot as the landscape shifts. Furthermore, environmental considerations and energy policies can impact operational viability, urging miners to be proactive in ensuring sustainability and compliance.

Ultimately, the allure of mining Bitcoin and other cryptocurrencies in Norway lies in the potential for substantial financial rewards amid a transformative technological wave. By aligning with efficient practices, investing wisely in equipment, and leveraging local resources, retail miners can carve a niche for themselves in the crypto economy. The keys to success involve a balanced approach, blending technology, strategy, and market awareness, ensuring that miners thrive in the icy shadows of Norway.

One response to “From Purchase to Profit: How Norway’s Retail Bitcoin Miners Thrive Today”

This article explores the innovative strategies employed by Norwegian retail bitcoin miners, showcasing their journey from initial purchases to sustainable profits. It highlights their unique business models, community engagement, and the impact of Norway’s energy landscape, offering insightful lessons for aspiring miners in a rapidly evolving cryptocurrency market.