As the cryptocurrency landscape continues its ceaseless evolution, the demand for cutting-edge mining hardware surges relentlessly. In 2024, the spotlight shines on the best Bitcoin mining hardware, highlighting industry giants like Canaan Avalon miners alongside other top-tier suppliers that dominate the market. These sophisticated rigs are not mere machines; they’re the backbone of the decentralized financial revolution, fueling Bitcoin and other cryptocurrency networks with unrivaled computational power.

Bitcoin mining, a complex process of verifying transactions and adding them to the blockchain, demands increasingly powerful equipment to keep up with the rising difficulty levels. Enter Canaan, a veteran entity renowned for its Avalon series. These miners harness specialized ASIC (Application-Specific Integrated Circuit) chips designed exclusively for Bitcoin’s SHA-256 algorithm. The Avalon miners excel in delivering high hash rates while maintaining energy efficiency—an essential balance where performance meets cost-effectiveness in the fiercely competitive mining arena.

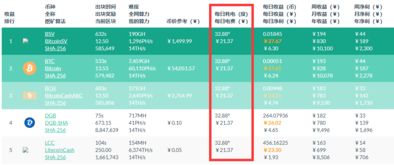

Yet, the world of crypto mining hardware extends far beyond just the Avalon lineup. Top suppliers such as Bitmain, MicroBT, and Ebang push technological boundaries, unveiling mining rigs that boast incredible processing speeds. Bitmain’s Antminer series, for example, has been a stalwart presence, continuously updated to handle Bitcoin’s ever-increasing network requirements. Meanwhile, MicroBT’s WhatsMiner models have earned accolades for their robustness and power efficiency, making them favorites among large-scale mining farms and individual miners alike.

Mining rigs themselves are intricate assemblies where hardware and software symbiotically coexist. Powerful ASIC chips are mounted on circuit boards, integrated with advanced cooling systems to dissipate the immense heat generated by nonstop computations. This is vital for ensuring longevity and uninterrupted operation, especially in hosting facilities where multiple rigs operate simultaneously—a critical factor for mining farm success.

Hosting mining machines has emerged as a game-changer, offering miners a stress-free avenue to optimize returns without grappling with electrical infrastructure, hardware maintenance, or cooling logistics. Companies specializing in hosting provide tailored environments with stable power supplies, cutting-edge ventilation, and seamless connectivity. Such setups empower miners to focus purely on strategic decisions, enabling scalable operations that can pivot swiftly as market conditions fluctuate.

The significance of mining farms cannot be overstated. Concentrated in regions abundant in renewable energy, these industrial-sized operations aggregate thousands of miners, transforming distributed networks into powerhouses with entrances into the financial veins of Bitcoin, Ethereum, and other consensus-based cryptocurrencies. Ethereum, for example, once reliant on GPU mining, has been gradually shifting its paradigm to proof-of-stake mechanisms, but the underpinning principle of mining hardware still resonates deeply within its community, demonstrating the diversity of hardware needs across blockchain ecosystems.

Diversification in hardware selection is a strategic imperative. While Bitcoin miners prioritize SHA-256 ASICs, altcoins like Dogecoin operate on merged mining protocols, enabling them to piggyback on the security of Bitcoin miners. This cross-currency mechanism exemplifies the intertwined nature of blockchain technologies and mining hardware. Miners capable of juggling multiple cryptos maximize profitability by dynamically switching between coins based on market trends, mining difficulty, and exchange rates.

Cryptocurrency exchanges, the neuronic hubs where digital assets trade hands, indirectly influence mining hardware demand. The price volatility of Bitcoin, Ethereum, Dogecoin, and others directly affects mining profitability, often dictating hardware upgrades or pivots to hosting solutions. A surge in Bitcoin’s price typically corresponds with a wave of hardware acquisitions, as miners scramble to scale their hash power, while dips invite strategic retreats and optimizations in operational costs.

Within this ecosystem, the miner—the human element behind the machines—plays a pivotal role. Expertise in selecting the right hardware, orchestrating mining farms, and seamlessly integrating hosting services is invaluable. The miner’s decisions extend beyond hardware specs into realms of software configuration, firmware updates, and real-time data analytics. This synergy creates formidable mining operations that not only contribute to blockchain security but also reap significant returns from block rewards and transaction fees.

Looking ahead, innovations continue to push mining technology toward increased efficiency and sustainability. The integration of AI-driven monitoring, renewable energy sources, and geographically strategic farm locations represents a new frontier. Suppliers are racing not only to produce the fastest machines but also the smartest ones—solutions that anticipate hardware failures, auto-optimize for energy consumption, and integrate seamlessly with cloud-based management systems.

As 2024 unfolds, the market for Bitcoin mining hardware remains vibrant and fiercely competitive. The alliances forged between seasoned manufacturers like Canaan, leading hosting service providers, and nimble miners define the undercurrents that shape the cryptocurrency mining industry. For anyone navigating this space, understanding the nuances of hardware capabilities, network algorithms, and market dynamics is essential. Only then can one harness the full potential of mining rigs, mining farms, and hosting facilities to thrive in the exhilarating world of digital currencies.

One response to “Best Bitcoin Mining Hardware 2024: Featuring Canaan Avalon Miners and Top Suppliers”

A deep dive into 2024’s Bitcoin mining scene! Canaan Avalon shines, but the best rigs & suppliers offer more than just hash rate; efficiency & reliability reign supreme.