In the ever-evolving world of cryptocurrency, the race to secure the most efficient mining hardware is more intense than ever. As digital currencies surge in popularity, miners scramble to upgrade their setups, seeking the gold standard in mining machines. Prices fluctuate, deals come and go, and spotting the hottest offers on mining rigs becomes an art form intertwined with market trends and technological innovations. Whether you’re engrossed in Bitcoin’s relentless dominance or exploring the vast ecosystem of altcoins like Ethereum and Dogecoin, the backbone remains consistent: mining machines and their hosting ecosystems.

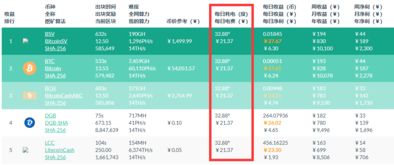

Mining farms, those colossal hubs of computational power, are not just technological marvels but also financial powerhouses. They exemplify economies of scale, leveraging massive arrays of miners to amplify hash rates. As demand for mining machines escalates, manufacturers respond by refining efficiency—offering models with better hash rates per watt, thereby slashing operational costs. For instance, Bitcoin mining rigs boast an intense computational prowess, designed specifically to hash millions of Sha256 algorithms every second. But competition isn’t limited to BTC miners alone; Ethereum mining rigs, adjusted for Ethash algorithms, cater to a different crowd, one that values a balance between power consumption and hash yields. The constant development cycle drives prices and availability, creating a dynamic marketplace vibrant with opportunity for shrewd buyers.

But acquisition is only half the story. Hosting services have emerged as a critical extension of the mining experience. Instead of wrangling with cooling systems, fluctuating electricity rates, and the heavy noise of machines, many miners prefer outsourcing their operations to specialized hosting providers. These companies offer turnkey solutions: secure facilities equipped with optimal HVAC systems, uninterrupted power supplies, and round-the-clock monitoring. Hosting your miners enhances uptime and protects the valuable hardware, simultaneously alleviating headaches associated with maintenance. Moreover, by pooling resources in mining farms scattered across different geographies, miners optimize risk and tap into regional energy advantages, further boosting profitability.

The flux in mining hardware prices must be contextualized within broader crypto market movements. Bitcoin’s price volatility often triggers waves of mining activity. When BTC prices climb, demand for miners spikes, occasionally leading to supply shortages and price hikes. Conversely, during downturns, prices might soften, opening opportunities for entering miners or expansions at bargain levels. The interconnection between cryptocurrency exchanges and mining activities also plays a subtle yet pivotal role. Efficient exchanges enable miners to liquidate earnings swiftly, influencing decisions around hardware investments. Equally important is the shift in consensus mechanisms—Ethereum’s transition toward proof-of-stake, for example, reshaped the demand dynamics for ETH mining rigs, urging a rethink in hardware procurement strategies and hosting contracts.

Dogecoin, often underestimated as a meme coin, has steadily carved out a niche in mining communities. Despite its Scrypt-based algorithm, shared with Litecoin, Dogecoin mining rigs tap into specialized equipment optimized for this algorithmic challenge. For miners focused on altcoins, these rigs represent a diversification strategy that can hedge against Bitcoin-centric market fluctuations. Interestingly, diversified mining operations incorporating rigs optimally configured for Dogecoin and other tokens underpin a healthy crypto ecosystem that extends beyond the titans of BTC and ETH. This diversification also encourages the proliferation of exchanges offering multiple trading pairs, reflecting a multi-asset mining strategy that smart investors are keen to adopt.

Delving deeper into the mechanics, the interplay of miner efficiency and hosting costs dictates the overall profitability formula. Cutting-edge Bitcoin miners boasting modest power draws but exceptional hash rates are hot commodities. Saving on electricity and cooling can substantially enhance margins, making hosting services that leverage renewable energy sources particularly attractive. As energy consumption remains a thorny debate in the crypto world, eco-conscious hosting solutions not only appeal to ethical considerations but also offer competitive pricing models. From large-scale operations to boutique setups hosting individual rigs, the landscape demands flexibility and innovative offerings, making the hunt for the hottest deals an ever-shifting puzzle rife with surprises.

In this whirlwind environment, staying informed becomes a miner’s best strategy. Price watch platforms, forums, and direct partnerships with mining hardware manufacturers are invaluable tools for those seeking timely deals. The rapid emergence of new models—some promising multi-terahash per second performance—fuels continuous evaluation of purchase timing. Whether you’re eyeing the latest Antminer, a high-efficiency Ethereum rig, or a multi-purpose miner capable of switching coins depending on market conditions, keen awareness of price trends and hosting opportunities can spell the difference between profit and loss. This fluid nexus between hardware capability, cryptocurrency valuations, and hosting innovations shapes the cutting edge of mining economies today and beyond.

One response to “Mining Hardware Price Watch: Spotting the Hottest Deals Now”

This article expertly navigates the volatile landscape of mining hardware prices, offering insights into current trends and pinpointing unbeatable deals. It combines expert analysis with practical tips for both seasoned miners and newcomers, making it a must-read for anyone looking to optimize their cryptocurrency investment strategy in today’s dynamic market.